Despite previous predictions the UK is expected to avoid a recession this year although inflation rates have reached levels markedly higher than forecast, suggesting that the short-term outlook remains unpredictable.

The ongoing war in Ukraine continues to push up energy prices, leading to a record spike in food prices and a dip in consumer confidence. This quarter has also seen a slight softening in the labour market as input prices including energy, supplier and business costs have risen. Despite this, on balance, Scottish firms are optimistic about the coming 12 months. The outlook is for a global economic recovery, but this remains fragile and levels of uncertainty about tipping points are higher than normal.

The Consumer Prices Index (CPI) measure of inflation, or the rate at which prices are rising, has dipped, but not by as much as hoped for. The CPI, which excludes housing costs, rose by 8.7 per cent in the 12 months to April 2023, down from 10.1 per cent recorded in March. Persistently high prices led the Bank of England to raise interests again in May to 4.5 per cent, but with a prediction that they will be able to bring the rate of inflation down to meet their 2 per cent target by late 2024. The International Monetary Fund has indicate that global inflation is unlikely to return to target before 2025.

Falling gas and electricity prices contributed to the dip in inflation in April. The rate of energy price rises over the 12 months to April slowed to 7.3 per cent, down from 11.6 per cent in March. However, food price rises remain high, underpinning the ongoing cost of living crisis for households. Restaurant prices also rose by almost 10 per cent. There was little change in the rate of inflation in other areas, although we saw a smaller but still significant rise in communications (7.9 per cent) and recreation and culture (6.9 per cent) while transport costs rose by a comparatively modest 1.5 per cent.

The Office for National Statistics’ (ONS) indicative modelled estimates suggest that the annual inflation rate for food and non-alcoholic beverages was the second highest seen in more than 45 years in April 2023, rising by almost 20 per cent for the second month in a row.

Spiking energy costs, supply chain disruption caused by the Russian invasion of Ukraine, rising labour costs, trading difficulties caused by Brexit, and unseasonably bad weather have contributed to rising food costs.

A recent ONS report confirmed that two thirds of UK adults reported that their cost of living had risen in May, a slight drop on the proportion reporting the same a month earlier. Other data suggest that for 40-45 per cent of the population rising inflation over the past 12 months has meant reducing their spend on food to cope.

Consequently, many UK shoppers are reportedly leaning increasingly towards own-brand products, with these lines growing by 15.2 per cent in May. The government is now talking to supermarkets about price caps on some items in order to bring food prices down. Looking ahead, the Bank of England predicted that a combination of factors which have been putting upwards pressure on prices are forecast to ease, including energy, bringing prices down over the coming year.

Higher prices were still impacting on retail sales in April. Easter saw retail sales rise by 9.1 per cent, driven by the health and beauty categories, but when inflation was considered the real value of sales rose by just 0.3 per cent. The figures also highlighted a divergence between spend on food and non-food items.

A squeeze on household incomes tends to mean that discretionary spending is cut back, something we can see in the latest data for sales of clothing, electricals and footwear. It remains to be seen whether the Coronation and multiple bank holidays in May will boost consumer confidence and retail sales to sufficiently offset higher prices, but the British Retail Consortium is forecasting stronger sales growth in the second half of the year.

Perhaps unsurprisingly consumer sentiment among Scots dropped in the first quarter of the year to a negative 17.1, significantly weaker than the same quarter a year ago, indicating beyond doubt that households are feeling the pressure of financial challenges.

Labour market conditions ease marginally

The data supports the view that we are seeing a slight softening in the labour market. UK monthly payrolled employee numbers fell in April, the first fall in more than two years. Similarly, the UK rate of unemployment increased marginally to 3.9 per cent in the three months to March, largely driven by an increase in the long-term unemployed. The equivalent rate in Scotland was 3.1 per cent, down marginally on the previous quarter, though still very low. Over the same period Scotland’s employment rate also fell slightly to 75.3 per cent, slightly below the UK’s rate.

The estimated number of vacancies in the UK also fell by 55,000 from February to April, down on the previous three months, the 10th consecutive quarterly fall. Surveys show economic pressures and rising costs are holding back recruitment. The number of days lost to labour disputes also rose by more than 200,000 in the month to March, to 556,000.

The Fraser of Allander Institute reports that employee costs have become the key driver of business costs for Scottish businesses, overtaking energy, inflation and credit in the last three months. Prices rose in the private sector in April at the fastest rate since January with both producers and manufacturers increasing selling prices, although the rate of increase overall is below the UK average.

The number of Scottish firms in the survey predicting reduced operations due to higher energy bills decreased to 39 per cent, down from 50 per cent in the last quarter, perhaps because some of the rises in costs are now being passed on to customers via higher prices. The figure remains higher in hospitality where 50 per cent of firms still expect to have to reduce their operations due to rising energy costs.

Business activity has continued to expand with the Royal Bank of Scotland Purchasing Managers’ Index (PMI) increasing for the third month in a row in April, to a ten-month high of 54.3, up from 52.9 in March. The percentage of businesses expecting weak or very weak growth remains high but also dropped to 62 per cent, down from 75 per cent.

The survey also highlighted that Scottish private sector firms remain relatively optimistic for the coming 12 months and are hopeful that improved demand conditions, business expansion and the launch of new projects will support future growth activity. That said, April represented a three-month low in the expectations data and Scotland is the second-least confident part of the UK.

GDP falls but is expected to recover in the short-term

With prices remaining relatively high, UK Monthly Gross Domestic product (GDP), a measure of economic activity, fell by an estimated 0.3 per cent in March 2023, following no growth in February 2023. This was despite the strongest monthly growth in production output since May 2021. Scotland’s GDP, based on experimental statistics, grew by 0.2 per cent in February, boosted by services output.

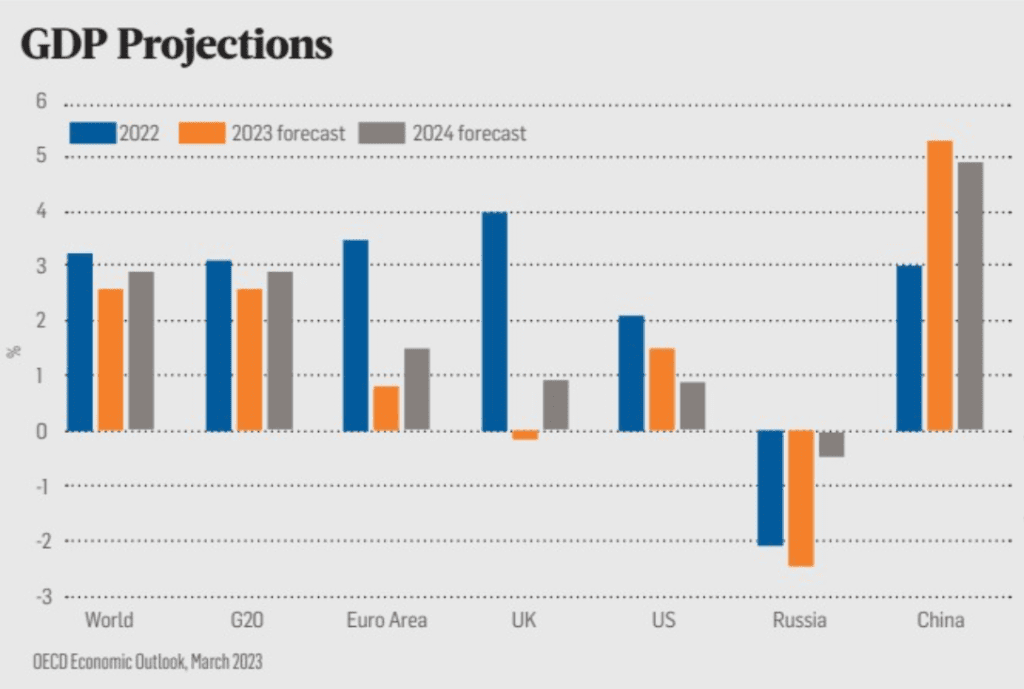

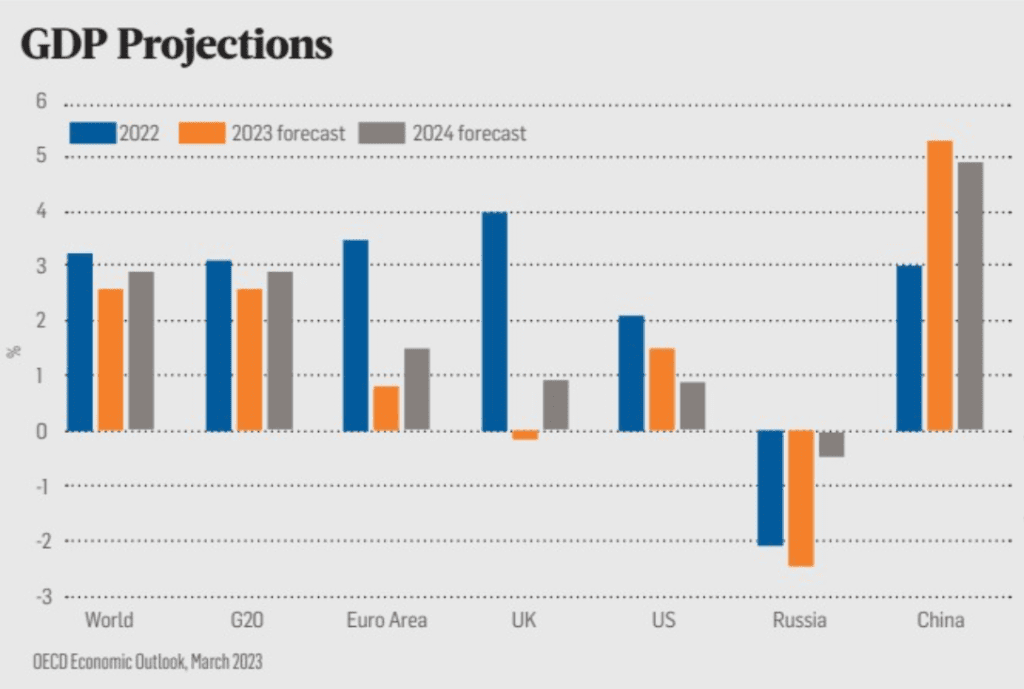

As with the UK, the global economy is recovering from the impact of the war in Ukraine, high inflation rates, slower GDP growth in China and lagging household incomes. Recent indicators, however, point to increased levels of activity in the next quarter and further improvement is forecast in 2023, though labour markets remain relatively tight. The Organization for Economic Cooperation and Development (OECD) predicts that global GDP growth will remain at a below-trend rate for 2023-24 with inflation set to lower over time.

The OECD projects growth in the US will slow to just 1.5 per cent this year and 0.9 per cent in 2024 while EU growth will reach just 0.8 per cent in 2023, before rising to 1.5 per cent in 2024 as energy price rises ease. It has revised its forecast for the UK GDP and the projected fall in 2023 is now expected to be a small expansion in output of 0.2 per cent, followed by a modest acceleration to 0.9 per cent growth in 2024, reflecting the recent dip in consumer sentiment and high prices. Scottish Fiscal Commission estimates predict Scottish GDP will rise by just 0.3 per cent this year rising to 1.0 per cent in 2024/25.

Recovery still hampered by high energy and consumer prices

Despite the gradual recovery in economic activity predicted in this quarter, consumer sentiment has dipped, and business confidence remains fragile. That said, both business activity this quarter and expectations about future activity have improved slightly. Expectations for future growth will underpin decisions about new recruitment and investment among businesses in Scotland and the UK.

While the war in Ukraine continues, however, there remains a good deal of uncertainty. Previous forecasts were underpinned by an assumption of stability, a prediction rocked by persistent disruptions caused by the conflict and its ripple effects in the wider global economy. Prices are expected to start to moderate later this year, something we have seen the first tentative signs of. Scotland and the UK will escape recession though growth rates will remain marginal in the immediate future.