Cost pressures ease slightly but concern remains over business confidence and forecasts of weak future growth

Following the UK Government’s autumn statement, the Scottish Government will be reflecting on its spending options for the forthcoming Scottish budget. While a drop in inflation has slightly eased cost pressures for households and businesses, business confidence has dropped, and weak economic growth will be a concern.

Measures to boost economic growth, ease cost pressures and support the most affected households are likely to be the priority.

As of the beginning of September, the Bank of England had raised interest rates 14 consecutive times to combat rising prices. However, the decision at the start of November to keep rates at 5.25 per cent for the second month in a row reflects their view that inflation will come down further in the coming months, though the Bank highlighted risks from the impact of global conflicts on the economy, the possibility that energy prices may rise again and a forecast for flat or falling output growth in the fourth quarter of this year.

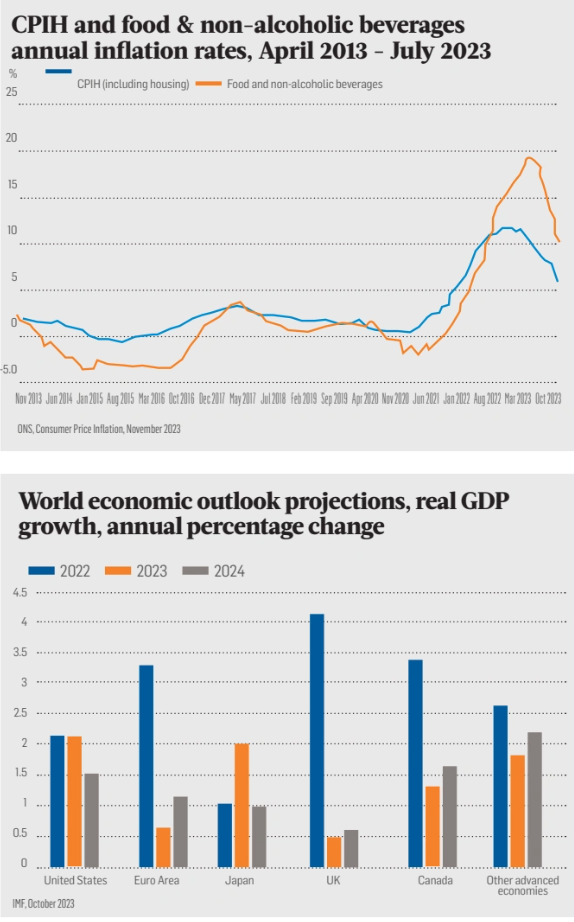

Consumer prices including housing costs, or CPIH, the main measure used to track inflation, rose by just 4.7 per cent in the 12 months to October 2023, down from the 6.3 per cent rise in September and half of the peak of almost 10 per cent a year ago.

There was small rise, 0.1 per cent, on the previous month. This means prices are still rising but not as fast. It is also worth remembering that this is still well above the historical target of 2 per cent. Excluding housing costs, inflation rose by a similar rate of 4.6 per cent in the 12 months to October 2023, down from 6.7 per cent in the previous 12 months.

The biggest contribution to the monthly change in both measures was from housing and household services where the annual rate of inflation was the lowest since records began due to a sharp drop in gas and electricity prices.

October also saw price rises in food and non-alcoholic drinks slow to just 0.1 per cent and no rises in restaurant or hotel prices. Rising prices in recreation and culture services, which includes gym memberships and football games, saw the largest positive contribution, rising by 0.7 per cent in the month.

Slower price rises in the UK are broadly reflected elsewhere with global inflation expected to slow to 6.9 per cent for this year, and again to 5.8 per cent in 2024 because of a combination of monetary policy and lower energy costs. Risks to this forecast include more climate-related and geopolitical risks and rates not coming down as fast as policymakers would wish.

In the UK, the Bank of England predicts inflation will fall to 4.6 per cent by the fourth quarter of 2023, but the 2 per cent target is now not expected to be met until the second half of 2025, driven primarily by falling energy prices and easing food price inflation.

Households and businesses still cutting to meet higher costs

Although inflation rates have eased the impact on households, relatively high prices remain. Nine in 10 adults reported an increase in their cost of living in November and of these 64 per cent reported that they were now spending less on non-essentials while 41 per cent were also spending less on food shopping and essentials.

The challenges for households are reflected in spending on the high street. Cost constraints, severe weather and disruption from global conflicts and strikes have impacted retail sales which increased by just 2.8 per cent on a like-for-like basis compared with October 2022, when they had increased by 4.0 per cent.

The Scottish Retail Consortium reports that the rate of expansion is also below the three-month and 12-month averages, suggesting a disappointing start to what is normally a strong spending quarter.

Spending was slower across all areas including in non-food categories. Retailers will be hoping that as prices come down further, this slowdown in sales is only temporary in the run-up to the busy Christmas period.

Despite the slowdown in housing cost inflation in October, housing costs remain high. Rental rates on private properties in the UK rose to a record high in the year to September, rising by 5.7 per cent, the largest annual percentage change since data collection began in January 2016.

In Scotland they rose 6.2 per cent in the period, the highest rate since 2012. It is worth noting that this is not an entirely like-for-like comparison as data for Scotland includes in-tenancy rents which have been capped since late 2022 with rises primarily coming from new rentals.

Over the period since 2015, rental prices have increased more in England and Northern Ireland than in Wales and Scotland, with Scottish rental price rises rising the slowest.

Looking ahead, and with no real increase in supply forecast and rising demand, Royal Institution of Chartered Surveyors suggests that rental prices could further increase by an average 4 per cent across the UK over the coming 12 months. Owner-occupiers are also feeling the pinch as mortgage rates have risen. In the UK, around a third of adults reported difficulty in paying their rent or mortgage in November, unchanged since October. However, there are some signs this quarter of mortgage providers starting to bring rates down which will bring relief to those able to take advantage.

Business activity slows, confidence dips

Scottish private sector business activity reported in the Royal Bank of Scotland regional purchasing managers’ index (PMI) survey, fell in Scotland for the second consecutive month in October, down to an index value of 46.5 from 49.3, the steepest decline in a year.

The most cited causes of this fall in output were worsening underlying demand and cost pressures, with the overall downturn of business activity being more pronounced than across the rest of the UK. According to this survey slower demand has still to impact on jobs as employers continued to increase workforce jobs at the fastest rate for five months, outpacing other UK regions.

The Federation of Small Businesses’ small business index for Scotland also worsened, showing that the number of small businesses reporting revenue declining was negative in October for the second quarter and consequently business confidence for the coming quarter also dropped sharply into

egative territory. In contrast to the PMI survey, employment trends among smaller businesses have now been negative for three consecutive quarters and the contraction in employment worsened in the most recent data for October.

With these conflicting employment trends, getting a picture at a national level overall has become a little trickier this quarter because of challenges with the official data over the summer.

The estimated number of payrolled employees in the UK, based on HMRC data, increased by 33,000 from September 2023 to October 2023, and is above pre-pandemic levels. It is worth noting that this is based on experimental HMRC data which may be revised in future, so should be read in this context.

In Scotland, the latest published data for the quarter to September 2023 based on the same source shows a similar picture with a 6,000 increase in employment, a small fall in unemployment and a small rise in inactivity.

Reflecting the weaker economic trends in recent months the number of vacancies organisations are looking to fill has continued to fall. From August 2023 to October 2023, relative to the previous quarter, the estimated number of vacancies at UK employers fell by 58,000, the 16th consecutive fall. A drop in vacancies was seen in 16 of 18 sectors with real estate, arts and entertainment and construction seeing the biggest drops.

In Scotland, a quarter of businesses reported a shortage of workers in October, down from roughly a third in the previous survey, the lowest percentage reported since October 2021. The industries in Scotland with the highest rates of worker shortages were construction and the accommodation and food services sectors.

Businesses in sectors with short- ages are managing these by asking existing employees to work increased hours, pausing trading in part or in whole, employing temporary workers and not meeting customer demands because of these shortages.

Despite this easing in labour market constraints, earnings continue to rise. Annual growth in regular pay, not including bonuses, rose in the UK by 7.7 per cent from July 2023 to September 2023, one of the highest rates seen in more than 20 years.

On a slightly different measure, gross median weekly earnings for full-time employees rose in the UK by 6.2 per cent in the year to November and 9.7 per cent in Scotland. This is the highest growth rate since the series began in 1997, but also must be seen in the context of high inflation rates over the same period.

Exports expanding, but growth is a concern

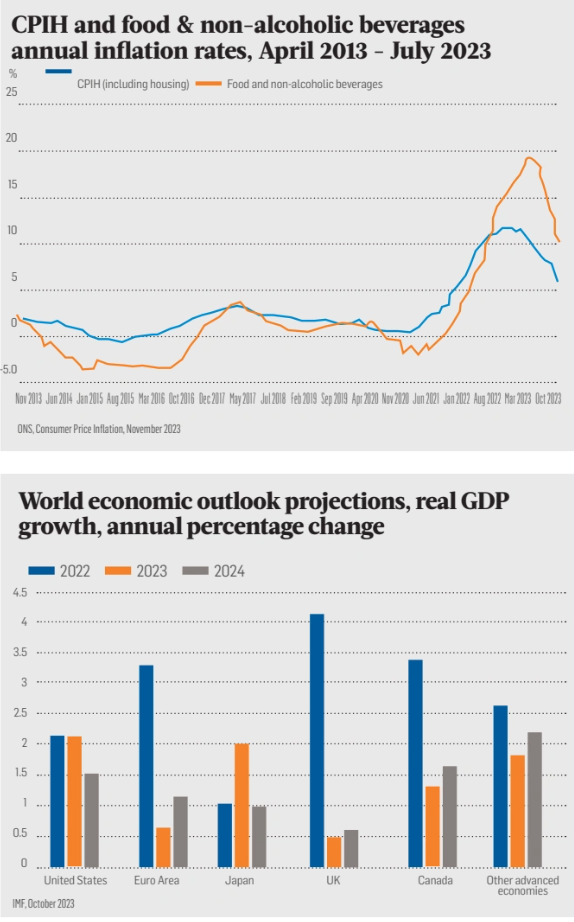

The International Monetary Fund’s latest forecasts suggest that global economic growth will be 3.0 per cent this year, slowing to 2.9 per cent in 2024 on the back of tightening monetary policy around the world to combat inflation, ongoing conflicts, and post-Covid-19 recovery.

The UK is predicted to be the weakest overall performer of the G7 advanced nations. Its economy is expected to expand by just 0.5 per cent in 2023 and 0.6 per cent in 2024. This expectation aligns with the latest quarterly UK GDP data which shows no growth in the quarter to September, following a small increase in the previous quarter.

Data for Scotland which is a month behind showed a small rise of 0.1 per cent in onshore Scottish GDP in August but no growth for the three months to August overall.

A drop in manufacturing activity in August had the biggest downward impact on the month’s outturn. The Fraser of Allander Institute’s latest forecasts predict output growth of 0.2 per cent in 2023, 0.7 per cent in 2024, and 1.2 per cent in 2025, a downwards revision to its earlier forecasts.

In terms of Scottish trade, importing and exporting trends are in the balance with 19.1 per cent of businesses which have exported in the last 12 months reporting increased exports in September 2023, relative to the same period a year ago against 17.4 per cent reporting diminished exporting rates. The most reported challenges in the government survey to importing and exporting businesses were transportation costs and additional paperwork, with the end of the EU transition period the most common reason given by 42 per cent of respondents for the challenges.

Prosper is a membership organisation which connects businesses, government and civil society in Scotland to shape policy and drive growth. It was formerly known as the Scottish Council for Development & Industry.